SLOCUM TWP. — Doctors told 72-year-old Wayne Womelsdorf to get his affairs in order after he was diagnosed with the most advanced form of lung cancer earlier this year, and straightening out his convoluted Luzerne County property assessment topped his list.

“I want to die in peace. I don’t want to leave this mess with her,” he said, referring to Lorraine, his wife of 40 years, who sat next to him on the couch of their Slocum Township home last week with a stack of records.

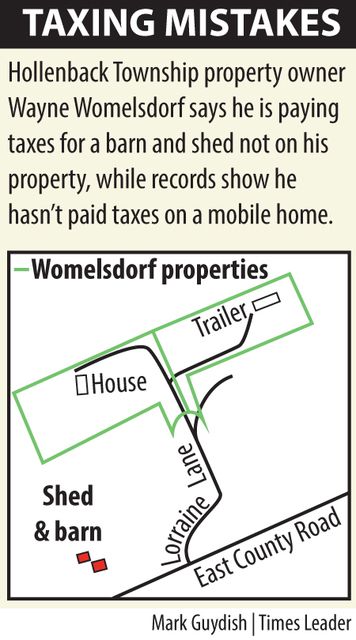

According to an extensive Times Leader review of property records and aerial imagery, the Womelsdorfs have been taxed for a barn and horse shed they don’t own on their land off East County Road in neighboring Hollenback Township.

This problem dates back to at least 2009, when the county completed a reassessment that was supposed to correct such errors.

Meanwhile, an older mobile home that’s been on their land for about a decade is not listed on their property records, an indication they were not taxed for it.

The errors compounded when they subdivided the land into three separate parcels last year.

A parcel containing only part of a common road, Lorraine Drive, was assessed $76,760 for a nonexistent structure that is not described in the records in addition to $12,240 for the 160-square-foot horse shed and a 1,200-square-foot barn they don’t own.

In the dark

County Assessment Director Anthony Alu said Thursday he was personally unaware of the problem and immediately sent a field evaluator to the property to examine it.

“We’re not here to hurt anybody,” Alu said. “We want to do the right thing.”

Alu said his office had no way of knowing there was an error years ago because the county relied on an outside contractor, 21st Century Appraisals Inc., to identify, photograph and value all structures as part of the countywide revaluation that took effect in 2009.

His office has a handful of evaluators who look for errors and missed properties, often based on tips and building permits, but Alu said he doesn’t have the manpower or funding to systematically reexamine all 166,000 properties. The administration continues to explore options for software programs that pinpoint and flag potential errors using satellite imagery and aerial photography, he said.

However, Alu acknowledged his office failed to follow through on an alert that could have detected the errors last year.

County records show the mapping department instructed the assessor’s office to revisit the properties last August at the time the subdivisions went through to make sure the structures attached to each parcel were accurate.

That inspection was not completed. Instead, the assessor’s office overrode the mapping hold code in the computer system so it could proceed with a required snapshot reading of the tax base called a certification. This override removed the properties from a flagged status, and the matter was forgotten.

As a result of the Womelsdorf situation, Alu said he has implemented a new policy.

A report on all pending hold codes now will be printed before each certification and provided to management, which will be responsible for ensuring all inspections are completed, he said.

Action planned

Based on the assessor evaluator’s review of the property Thursday and Friday, Alu said his office will remove the barn and horse shed in addition to another $76,760 in assessment that was incorrectly added for 2016.

The office also will start taxing the missed mobile home and another small, old mobile home found on the property, he said. The assessment amount for the mobile homes will be calculated next week.

Taxing bodies can issue a refund dating back five years if an error was discovered causing a property owner to be overcharged, Alu said. There’s no recourse for claiming overpayments in 2009 and 2010.

Based on school, county and municipal tax rates from 2011 through 2015, the Womelsdorfs may be entitled to a refund of around $1,040 for the barn and shed.

Photographs of the same barn and shed appear in the assessment records of another adjacent, unrelated property owner who bought land from the Womelsdorfs in 1991. This property owner later built the structures for horses and has been paying taxes on them, records show.

The county can’t recoup tax payments on the missed mobile homes because the law does not allow such retroactive charges, Alu said.

County will pay

Womelsdorf, who worked in the freight and construction businesses, said he will submit the required request to receive a refund for his overpayments on the barn and shed, even though he got a break on the mobile homes.

He said the smaller mobile home is “junk” with a rotted floor, but his plans to haul it away were waylaid by his illness.

Womelsdorf said he added the other mobile home about 10 years ago, sought building permits and did not realize it was missed by the assessor’s office.

He said he twice paid lawyers who did not correct the problems as requested and gave up fighting himself after several assessment challenges in the early 1990s.

“They put me through hell. They’re going to pay for it this time,” he said of county government.

Womelsdorf said he and Lorraine, also 72, have always faithfully paid their property taxes, even though they had no faith they were accurate.

His wife said she drives an old car and continues to work as a phlebotomist because she wants to ensure they pay their bills.

“We’ve always worked hard,” she said, tears welling in her eyes as he talked about his illness.

“I want her to stay home. She needs a new knee, but she says she has to keep going,” he said.