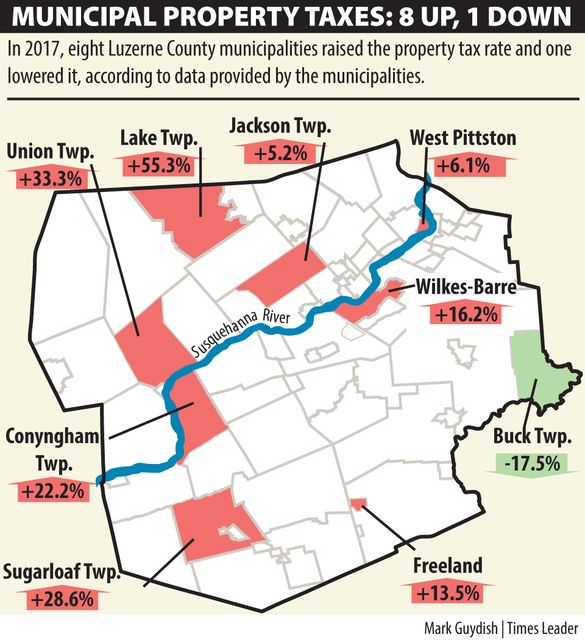

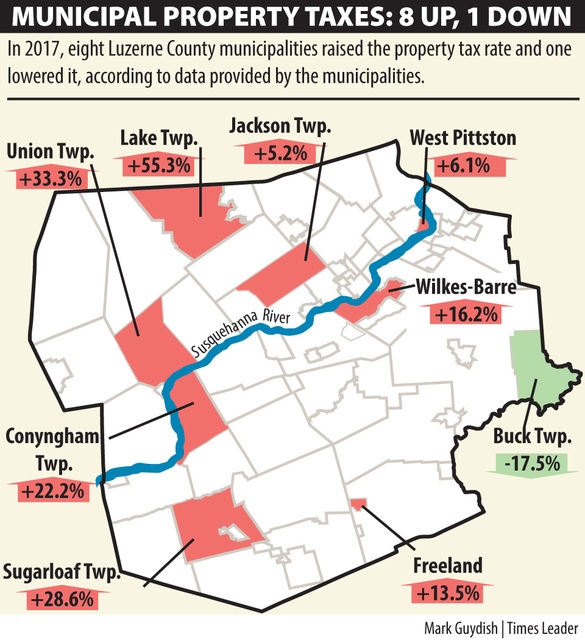

Eight of Luzerne County’s 76 municipalities are increasing real estate taxes this year, a review of new data from the county treasurer’s office and municipalities shows.

Lake Township has the highest percentage increase — 55.

The township’s rate rose from 0.322 mills to 0.5 mills. That means someone with a $100,000 property will pay $17.80 more, with the total municipal tax bill increasing from $32.20 to $50. A mill is $1 tax for every $1,000 in assessed value.

The next highest percentage — 33 — was in Union Township, where taxes increased from 0.3 to 0.4 mills.

The other increases:

• Sugarloaf Township, 28.6 percent, from 1.05 to 1.35 mills.

• Conyngham Township, 22.2 percent, from 1.127 to 1.377 mills.

• Wilkes-Barre, 16.2 percent, from 121.63 to 141.33 mills.

The city’s millage can’t be fairly compared with other municipalities because the city opted to continue using its old assessed values for city property taxes while all others use those from the county’s 2009 reassessment. As a result, the city’s assessments don’t correlate to current market values.

• Freeland, 13.5 percent, from 3.7 to 4.2 mills.

• West Pittston, 6 percent, from 3.26 to 3.4591 mills.

• Jackson Township, 5 percent, from 1.92 to 2.02 mills.

Conyngham Township Supervisor Ed Whitebread said Friday the hike was needed in his municipality to cover increased costs for township services.

Jackson Township supervisors last month also cited rising costs for insurance, equipment, payroll and health care.

Union Township officials blamed their increase last month on higher costs for road maintenance and health insurance, saying they expected to generate an additional $14,000 from the tax hike.

Council members in West Pittston said their increase would provide additional revenue for the West Pittston Fire Department.

The hike in Wilkes-Barre also was needed to fund rising operational costs and employee wages, officials have said.

Slocum Township remains the only municipality with no local real estate taxes. Officials there are trying to survive on state liquid fuel and wage tax revenue.

Pittston city has the highest rate of 6.85 mills, followed by Nanticoke at 5.9258 mills and Plymouth at 5.7 mills.

Buck Township stands out among the pack because it is decreasing its taxes in 2017, from 0.1212 to 0.1 mills, township Supervisor Bonnie Weed said Friday.

The owner of a property assessed at $100,000 will now pay $10 instead of $12.12 for township taxes. Several residents attending the December budget adoption meeting were “very happy” municipal officials were passing on savings to them, she said.

Weed said the small, rural community of 500 residents, which borders Monroe County, has only two roads requiring maintenance. Residents make their own arrangements for garbage collection and have their own septic systems and wells, she said.

“They don’t ask for many services, and we don’t offer them. It works for everyone,” Weed said. “Everybody seems to be content with what we have.”

Property owners in all municipalities must pay 4 percent more in county taxes this year. The owner of a property assessed at $100,000 pays $575 in county taxes under the previous tax rate of 5.7456 mills. A mill is $1 tax for every $1,000 in assessed value. The tax rate will increase 0.2298 mill.

The county administration said the additional $4.2 million from the hike was needed for an increased employee pension fund subsidy, higher staffing costs, anticipated litigation settlement expenses and other payments that will allow the county to maintain the same level of services.